You are running a business with great product quality and service. The setup is perfect, and the team and strategies are efficient. However, poor financial management can ruin all of these. Maintaining a consistent position in the market has become a hard grind for businesses.

The type of business and the unique service you plan to offer eventually create a path to your success, but cash flow is the lifeblood of your business. It powers your business’s growth, manages operations, and transforms your business ideas into products and services. Cash flow is easier said than done. It is not just about having money in your bank, rather it ensures the in and out of cash movement to help your business grow and succeed in the competitive market.

This article will discuss the concept of cash flow management in business, its significance, and how wise management would make your business grow rich.

What Does Cash Flow Management Mean?

Cash flow management in business is the process of tracking, analyzing, and optimizing the money coming into and going out of your business. It ensures that your company has the right amount of cash on hand to meet its requirements while also planning for future financial needs.

Effective cash flow management involves more than just balancing the books, it’s about making informed decisions to allocate resources wisely and keep your operations running smoothly.

Why Does It Matter So Much?

Because even profitable businesses can run into trouble if they don’t manage their cash flow well. Many people think that if their business is profitable, they don’t need to worry about cash flow. But here’s the thing, profit is just a number on paper, while cash flow is real money in your account. For example, if your customers are slow to pay invoices, but have a cash crisis can develop, jeopardizing your operations Let’s say you made a $10,000 profit this month, but your customers haven’t paid their invoices yet.

You still need to pay your employees, rent, bills to settle, and other expenses. Without cash on hand, you could end up in trouble despite being profitable. This creates a cash crisis which jeopardizes your operations. So, cash flow management in business is often more important than profit to maintain steady success.

Good cash flow management enables you to:

- Pay employees and vendors on time

- Handle unexpected expenses

- Avoid debt traps

- Invest in growth opportunities

- Maintain financial stability

How Does Cash Flow Management Function?

Cash flow management in business works by tracking, analyzing, and optimizing the movement of money in and out of a business. It ensures that a company has enough cash on hand to cover daily operations, settle debts, and invest in growth.

Here are some of the main functions of cash flow management in business:

1. Monitoring Cash Inflows and Outflows

The first step in cash flow management is keeping a check on where the money is coming from and where it’s going. By tracking transactions, businesses can identify patterns, spot problems, and make wise financial decisions.

- Cash Inflows: Revenue from sales, loans, investments, or asset sales.

- Cash Outflows: Expenses such as payroll, rent, utility bills, and loan repayments.

2. Forecasting Cash Flow

Effective cash flow management in business involves predicting future cash needs. Businesses create forecasts by analyzing past cash flow data and factoring in upcoming expenses and revenue expectations. For example, if a company anticipates a large purchase or a slow sales period, it can adjust its strategy in advance to maintain liquidity.

3. Balancing Cash Flow

The goal of cash flow management is to maintain a positive cash flow where inflows exceed outflows. When outflows are higher than inflows, businesses may face a cash crisis, leading to late payments or missed growth opportunities.

Balancing cash flow involves:

- Delaying non-essential expenses

- Accelerating customer payments

- Negotiating favorable terms with suppliers

4. Utilizing Cash Flow Tools and Software

Modern businesses often rely on accounting software to automate cash flow tracking. These tools provide insights and generate reports to help businesses make appropriate financial decisions.

5. Implementing Cash Flow Strategies

Businesses adopt various strategies to manage cash flow, such as:

- Invoicing Early: Sending invoices promptly to encourage faster payments

- Cost Control: Identifying and cutting unnecessary expenses

- Emergency Funds: Keeping a cash reserve for unexpected expenses

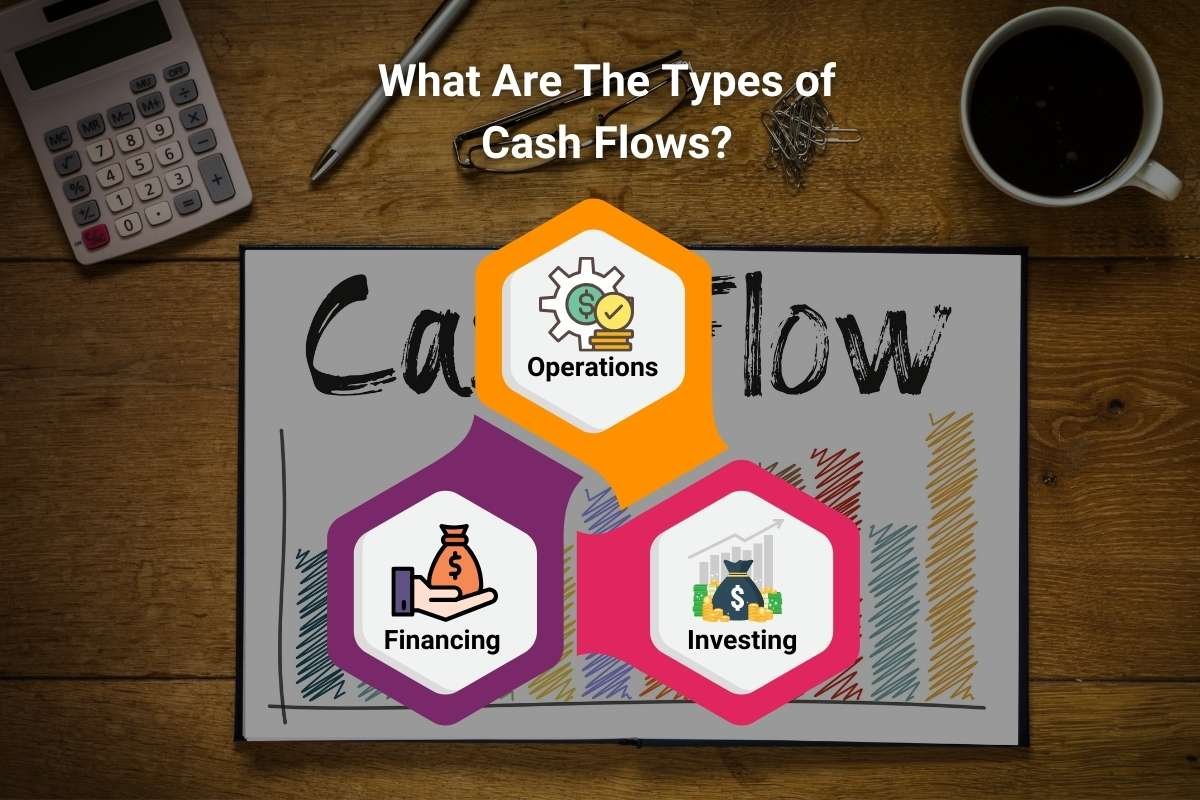

What Are The Types of Cash Flows?

Cash flow management in business isn’t just about tracking money in and out, there are different types of cash flow to understand. Knowing these categories is essential for creating a smart cash flow strategy that works for your business.

1. Cash Flow from Operations (CFO)

This refers to the money flowing in and out of your business from daily operations. It includes expenses like raw materials, wages, and infrastructure costs, as well as revenue from the sale of products or services. The CFO clearly shows how well your core business activities are generating cash. This type of cash flow is crucial for most businesses.

2. Cash Flow from Investing (CFI)

This covers the money spent or earned through investment activities, such as purchasing new equipment or selling old assets. CFI often shows how a company is planning for long-term growth and development.

3. Cash Flow from Financing (CFF)

CFF tracks cash coming in or going out due to financing activities. This includes taking loans, repaying debt, or securing funds from investors. While each type of cash flow plays a role in your business’s financial health, cash flow from operations typically holds the most importance. Keeping a check on these categories is key to mastering cash flow management in business.

While all three types of cash flows are important, operating cash flow typically carries the most weight for businesses. It reflects the core strength of your operations, whether your business can cover its expenses and still generate profit. Understanding and tracking all three types of cash flow will give you a clearer picture of your company’s overall financial health.

How to Improve Cash Flow Management in Business?

Managing cash flow can be tricky, but there are simple ways to make it better. Whether you’re dealing with money challenges or just want to keep your business running smoothly, here are some practical ideas to help you improve cash flow management for your business.

1. Get Better at Cash Flow Forecasting

Knowing how much money is coming in and going out in the future can help you stay prepared. When you have a clear picture of your cash flow, you can plan smarter, which means investing in growth or saving for tougher times. Using technology can make this easier. Cash forecasting tools let you run different what-if scenarios, helping you see potential risks and opportunities. This gives you the confidence to make better money decisions.

2. Speed Things Up with a Shorter Cash Conversion Cycle

One key to better cash flow management in business is reducing the time it takes to turn money into goods and back into money again. In simple terms, make sure that you use the cash. Start by making small changes, like encouraging customers to pay faster. You can offer discounts for early payments or tighten credit terms if needed. At the same time, look at how long you take to pay suppliers. Clearing out slow-moving stock can free up cash that’s better spent elsewhere

3. Manage Inventory Wisely

How you handle inventory has a big impact on cash flow management in business. Keeping too much stock ties up money that you could use elsewhere. But having too little could mean missed sales. If you need a short-term boost in cash, think about reducing the extra stock you hold and be mindful of potential sales risks. For businesses focused on long-term stability, keeping a good safety stock might be worth the short-term cash hit.

Conclusion

Effective cash flow management in business is about more than just tracking numbers, it’s about making smart decisions that promote growth and stability. During these days of tough competition, you must understand every aspect of your business’s cash flow movements to make wise financial decisions. Good cash flow keeps your operations steady, your goals achievable, and your business succeed.