Key Points:

- Lenskart IPO GMP Falls: The Lenskart IPO GMP dropped to ₹42 ahead of its Nov. 10 listing, hinting at a muted debut.

- Strong Demand: The issue was subscribed 28.27 times, led by high QIB and retail interest.

- Solid Fundamentals: Despite valuation concerns, Lenskart’s brand strength and omnichannel model support long-term growth.

New Delhi, Nov. 5, 2025 — The grey market premium (GMP) for the Lenskart IPO has declined sharply ahead of its listing, raising concerns about a subdued market debut despite strong subscription numbers.

The IPO, which opened for subscription on Oct. 31 and closed on Nov. 4, saw an overall subscription of 28.27 times, driven by robust interest from institutional and retail investors. However, the GMP — considered an early indicator of listing performance — fell to Rs 42 as of Nov. 5, down significantly from earlier levels.

With a price band set between Rs 382 and Rs 402 per share, the estimated listing price now stands around Rs 444 per share, reflecting a modest 10.45% premium over the issue price. Market analysts said the decline suggests reduced investor enthusiasm in the unlisted space, possibly due to concerns over valuation and broader market volatility.

Strong subscription across categories

According to exchange data, the Lenskart IPO received a category-wise subscription of 7.56 times by retail investors, 40.36 times by Qualified Institutional Buyers (QIBs), and 18.23 times by Non-Institutional Investors (NIIs). Analysts said this strong response underscores Lenskart’s brand strength and leadership in India’s expanding eyewear market.

“The IPO saw an overwhelming rush from investors across the board. That said, while the numbers look stellar, such oversubscription often reflects short-term excitement rather than deep conviction in fundamentals,” Gaurav Garg, Research Analyst at Lemonn Markets Desk, said.

Offer structure and issue details

The Rs 7,278.02 crore Lenskart IPO comprises a fresh issue of Rs 2,150 crore (5.35 crore shares) and an offer for sale (OFS) worth Rs 5,128.02 crore (12.76 crore shares) by existing shareholders. The minimum investment for retail investors was Rs 14,874 at the upper price band, based on a lot size of 37 shares.

For small non-institutional investors (sNIIs), the minimum investment stood at Rs 2,08,236 (14 lots), while large NIIs (bNIIs) needed to invest Rs 10,11,432 (68 lots).

The allotment of shares for the Lenskart IPO will be finalised on Nov. 6, and the stock is scheduled to list on both the BSE and NSE on Nov. 10, 2025. MUFG Intime India Pvt. Ltd. is serving as the registrar for the issue.

Company background and outlook

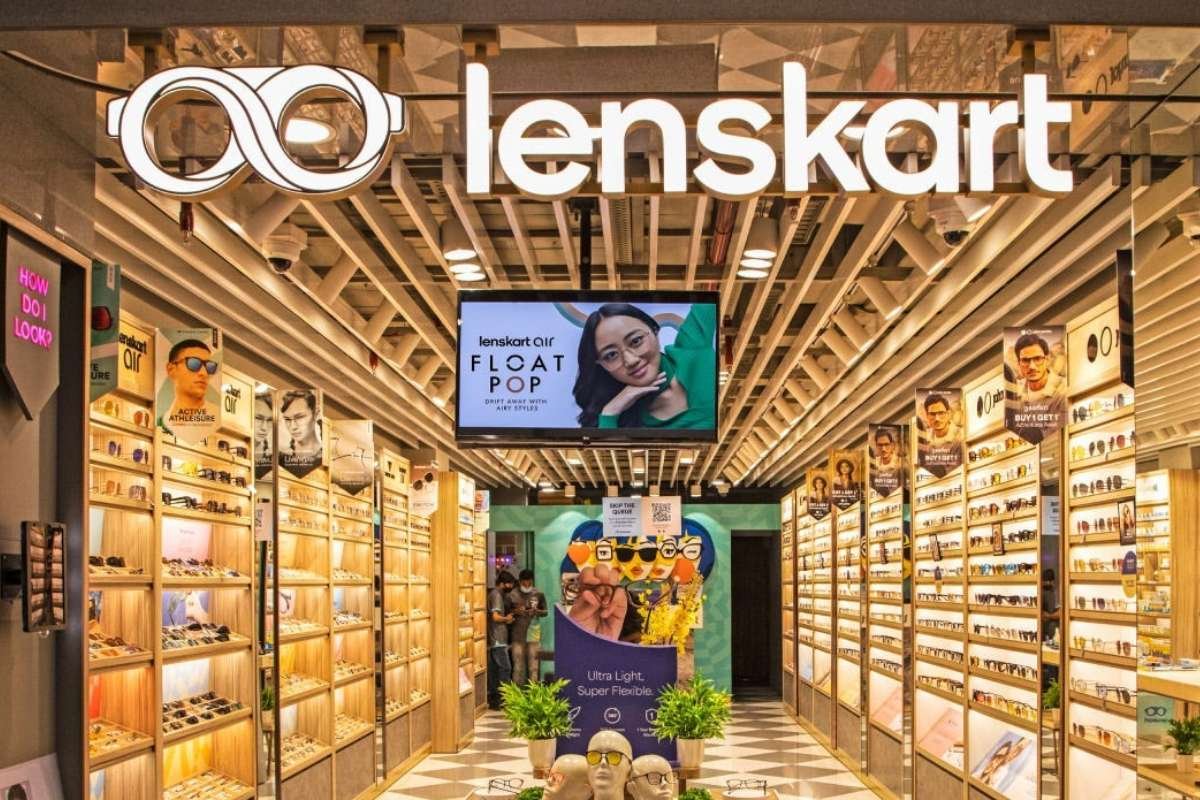

Founded in 2008, Lenskart Solutions Ltd is one of India’s leading omnichannel eyewear retailers, offering prescription glasses, sunglasses, contact lenses, and related accessories. The company operates through its online platform and a fast-growing network of offline stores across India and select international markets.

Lenskart’s business model integrates technology-driven customization with in-store experiences, enabling customers to try and purchase eyewear conveniently. The company also designs and manufactures its own products, allowing for greater control over pricing and quality.

Market observers said that while Lenskart’s strong brand recall and digital-first strategy support long-term prospects, its near-term listing performance will depend on market sentiment and valuation comfort among investors.

Despite the decline in GMP, analysts believe the company’s fundamentals remain solid. “Lenskart’s market leadership and omnichannel presence offer a strong growth runway. However, the listing day performance will likely hinge on broader equity market cues,” an analyst tracking the issue said.

As the company gears up for its Lenskart IPO listing Nov. 10 listing, investors and analysts alike will be watching closely to see whether the eyewear retailer can defy grey market expectations and deliver a clear vision for the markets.

Visit Business Viewpoint Magazine For The Most Recent Information.