Startups secured nearly $145 billion in funding during Q1 2026, primarily driven by sustained investor interest in AI-led ventures. So, how do you get financing for a startup? Even with capital flowing, it remains a challenge for most founders. Close to 70% fail to raise capital because they cannot demonstrate traction. Investors now prioritize measurable customer growth, repeat usage, and early revenue over vision alone.

The funding process has become more selective, not inaccessible. Banks remain risk-averse toward early-stage companies, while private investors demand clearer signals of execution before committing capital. Founders often approach fundraising without a defined strategy, relying on outreach volume rather than investor fit. This mismatch is a primary reason capable teams fail to close rounds.

Currently, Funding for a Startup blends traditional disciplines with newer mechanisms. AI-driven tools support sharper financial forecasting and tighter investor materials. Alternative capital models, including revenue-based financing and regulated digital asset offerings, have gained credibility among Western investors. These options prioritize operational clarity over aggressive growth projections. How to get funding for a startup now depends less on persuasion and more on preparation, positioning, and timing.

This article outlines six investor profiles and seven proven funding strategies, while highlighting the critical errors that stall growth. It provides founders with a precise framework to secure capital with strategic intent.

2026 Funding Trends

Investors became more discerning after the 2025 market cooldown. They now demand clear paths to profit, not just wild growth stories. Getting funding for a startup means proving your numbers add up quickly.

Cash flows to businesses that stretch every dollar. Founders aim for 24 to 30 month runways, up from shorter ones in boom years. Hot areas include AI tools, health innovations, and green energy projects. Banks and traditional loans still work for steady operations, but equity deals dominate significant raises.

New tools changed the gam, too. AI platforms match founders with investors based on pitch data and traction stats. Crypto funding for blockchain startups hit $588 million early this year, with tokens used alongside equity. Founders tap these for quicker closes, especially outside coastal hubs like Austin or Miami, where costs stay lower.

6 Types of Investors for Startups

How to get funding for a startup starts with knowing your backers. Not all investors fit every business. Some love early risks, others want proven cash flow. The table below provides a quick scan, followed by a detailed classification to help you build your pitch plan for 2026.

1. Angel Investors

Angel investors are typically former founders or senior operators who invest personal capital into early-stage startups. They usually write checks ranging from $25,000 to $500,000, making them best for pre-seed rounds when a product exists but revenue is still limited. Speed is their main advantage. Decisions often happen within weeks, and many angels actively contribute through introductions, hiring advice, or strategic guidance based on prior startup experience. In 2026, syndicates are common, allowing multiple angels to pool capital and reach $500,000 to $1 million rounds without traditional VC pressure.

Modern platforms now play a larger role. AI-driven tools on platforms like AngelList Pro analyze traction metrics and founder profiles to recommend aligned investors, significantly improving close rates. Founders often succeed by targeting retired executives or operators in their industry on LinkedIn, in private groups, and at local founder events. A concise 10-slide deck covering the problem, solution, early traction, and funding ask remains the standard. Dropbox famously used early angel funding to validate demand before scaling. Angels rarely lead later rounds, so founders should plan early for follow-on capital.

2. Venture Capital Firms

Venture capital firms manage institutional funds and seek outsized returns from scalable businesses. Typical investments range from $1 million to $10 million, spanning seed through Series A. Beyond capital, VCs provide access to senior talent, enterprise partnerships, and future fundraising support. Large firms like Sequoia or Andreessen Horowitz often anchor rounds, while micro-VCs increasingly dominate early seed stages.

Currently, VC scrutiny has intensified. Funds now emphasize capital efficiency, gross margins near or above 70%, and disciplined customer acquisition costs. Equity dilution often reaches 15–25%, accompanied by board oversight. Founders identify suitable firms using platforms like OpenVC and Crunchbase, filtering by stage and sector. Warm introductions remain critical, as most deals originate from existing networks. Airbnb secured early VC backing by demonstrating consistent booking growth despite early skepticism. Repeat founder experience and execution history now heavily influence outcomes.

3. Corporate and Strategic Investors

Corporate investors deploy capital to access innovation aligned with their core business. Banks back fintech platforms, manufacturers fund automation, and energy firms invest in climate technology. Investments typically begin at $5 million during Series A or later and may include commercial pilots, revenue-sharing agreements, or long-term partnerships. Benefits include instant credibility, enterprise distribution, and operational scale.

Trade-offs exist. Corporate investment cycles move more slowly, and strategic alignment can limit future flexibility. In 2026, corporate venture arms are especially active in AI infrastructure, enterprise automation, and sustainability. Firms like JPMorgan increasingly prioritize solutions that reduce costs or improve efficiency. Founders should approach through dedicated corporate venture teams and clearly quantify mutual value. Beyond Meat’s early partnership with Tyson illustrates how strategic capital can accelerate distribution. Due diligence tends to focus heavily on intellectual property and team depth.

4. Accelerators and Incubators

Accelerators provide early capital, mentorship, and exposure in exchange for equity, typically investing $50,000-$150,000 for 5–7% ownership. Programs such as Y Combinator and Techstars run structured cohorts lasting three months, combining workshops, mentor access, and investor demo days. Graduates often leave with refined products, stronger metrics, and extensive investor pipelines.

Acceptance rates remain below 2%, reflecting intense competition. In 2026, many programs operate hybrid or fully remote cohorts, with a strong emphasis on AI-native startups and distributed teams. Applications usually require an MVP, a short pitch video, and a straightforward founder narrative. Airbnb and Dropbox both emerged from Y Combinator, setting a clear precedent. Data shows that accelerator graduates increase post-program funding odds severalfold, with follow-on initiatives like YC Continuity extending long-term support.

5. Family Offices

Family offices manage private wealth for high-net-worth families and typically invest at later stages, often writing checks of $10 million or more. These investors favor long-term value creation over rapid exits and are comfortable targeting 20–30% annual returns across extended horizons. Founders benefit from flexible deal terms, reduced bureaucracy, and stable capital partners.

Decision timelines can be slower due to internal governance. In 2026, many family offices allocate capital to crypto, AI infrastructure, and web3 diversification strategies. Founders usually connect through wealth advisors, private forums, or trusted intermediaries. Emphasis should be placed on predictable revenue, downside protection, and capital preservation—Spanx leveraged family office funding to scale quietly, free from public pressure. Valuations tend to remain founder-friendly.

6. Crowdfunding Backers

Crowdfunding enables startups to raise $100,000 to $2 million from a large base of individual supporters through platforms like Kickstarter and Indiegogo, or equity portals like Wefunder. This approach validates demand, builds early communities, and generates marketing momentum without immediate institutional control.

Costs include platform fees ranging from 5–12%, increased public scrutiny, and ongoing investor communication requirements. In 2026, crowdfunding platforms increasingly use data models to forecast campaign performance before launch. Successful campaigns rely on strong video storytelling, clear rewards, and realistic timelines. Pebble Watch raised over $10 million through crowdfunding, proving its scale potential. In the US, equity crowdfunding operates under Regulation CF, which caps individual investment limits and requires ongoing disclosures.

Seven Proven Strategies to Get Funding

How to get funding for a startup comes down to repeatable actions that work across cycles, adjusted for current investor behavior. These seven strategies reflect what founders are executing successfully in 2026 and what investors consistently respond to. Each approach aligns with a specific stage and works best when combined deliberately rather than pursued in isolation.

1. Bootstrap with AI Tools for Lean MVPs

Self-funding through savings or early revenue allows founders to validate demand without external pressure. No-code platforms like Bubble and AI-assisted coding tools such as Cursor enable faster, lower-cost product launches. Many founders now aim for $10,000 in monthly revenue before approaching investors, signaling discipline and control.

GitLab scaled to millions in revenue before raising institutional capital. In 2026, AI-driven development reduces build time by up to 70%, allowing small teams or solo founders to test markets efficiently—financial tools like Forecastr help model cash flow and runway. A common risk is burnout; outsourcing targeted tasks to freelancers early helps maintain momentum.

2. Nail Traction Metrics First

Investors prioritize evidence over projections. Strong signals include consistent month-over-month growth or early revenue stability. For SaaS startups, benchmarks often include 40–50 paying customers at meaningful average contract values. Analytics platforms like Mixpanel or Amplitude help track retention and engagement.

Spanx reached $4 million in sales before accepting outside capital. In 2026, investors closely examine unit economics, particularly customer acquisition cost relative to lifetime value. Landing pages and waitlists built with tools like Carrd can serve as early indicators of demand. Vanity metrics without retention rarely influence funding decisions.

3. Craft Data-Driven, AI-Optimized Pitches

Generic pitch decks underperform. Founders increasingly use tools like PitchBob or Beautiful.ai to structure data-backed presentations. Customization matters; referencing an investor’s prior deals or sector focus improves response rates. Effective decks remain concise, usually under 15 slides, with a clear funding ask.

Airbnb’s early pitch success came from demonstrating execution, not polish. In 2026, founders use AI-powered rehearsal tools to refine delivery and identify weak sections. Peer feedback from founder groups often precedes investor outreach. Missing or vague financial projections remain a common reason pitches stall.

4. Target Curated Networks and Platforms

Warm introductions outperform cold outreach. Platforms such as OpenVC and Signal by NFX match startups with relevant investors based on stage and sector. Demo days, local pitch events, and accelerator networks remain effective entry points when followed by consistent updates.

Dropbox gained early investor attention through a simple product demo video. In 2026, matching platforms increasingly use performance data to score investor fit, improving lead quality. Founders who build visibility by engaging thoughtfully on LinkedIn tend to convert conversations more effectively than those relying on mass emails.

5. Secure Non-Dilutive Grants and SBA Programs

Grants and government-backed funding reduce dilution while extending the runway. Programs like SBIR and STTR offer phased funding that can exceed $1.5 million for qualifying research-driven startups. SBA Lender Match continues to connect founders with approved lenders offering favorable terms.

Beyond Meat leveraged early USDA grants to fund product development. In 2026, public funding priorities emphasize AI, healthcare, and climate innovation. Successful applications align closely with agency objectives and include detailed financial planning. Missed deadlines often delay funding by an entire cycle.

6. Use Revenue-Based Financing and Selective Debt

Funding for a Startup with predictable revenue may qualify for revenue-based financing through platforms like Pipe or Clearco. These models exchange a percentage of future revenue for upfront capital without equity dilution. Effective rates typically range from 8 to 12%.

Shopify used revenue-linked funding during its growth phase. In 2026, SaaS businesses with at least $20,000 in monthly recurring revenue often receive fast approvals through API-based data access. This option suits stable revenue profiles; companies with uneven cash flow face a higher risk. Traditional SBA 7(a) loans remain available up to $5 million.

7. Capitalize on Pitch Competitions and Regulated Crypto Rounds

Pitch competitions offer capital, exposure, and validation. Events such as Rise of AI and regional startup challenges regularly award six-figure prizes. For web3 startups, regulated equity and token combinations via platforms like Republic have gained traction.

Allbirds benefited from early exposure to competition at TechCrunch Disrupt. In 2026, crypto-based fundraising surpassed $500 million in Q1, though compliance remains critical. Campaigns require clear value propositions, transparent token structures, and dedicated marketing budgets. Fees and promotional costs should be carefully planned.

Common Funding Mistakes That Kill Deals

Many founders miss out on cash by repeating avoidable errors. Getting funding for a startup demands sharp eyes for these traps. Each one below packs real costs, lost time, burned bridges, or worse. Spot them early to boost your close rate.

- Raising Too Early: Approaching investors without traction wastes time and credibility. Most investors expect usage data, early revenue, or customer validation before engaging seriously. Early outreach often leads to long gaps and stalled conversations.

- Overestimating Valuation: Founders frequently price rounds based on ambition rather than benchmarks. Inflated valuations reduce investor interest and complicate future raises. In 2026, investors favor fair pricing tied to progress, not potential alone.

- Ignoring Financial Clarity: Unclear revenue models, weak forecasts, or missing cost breakdowns signal poor execution. Investors expect clean numbers, realistic assumptions, and visibility into burn rate and runway.

- Pitching the Wrong Investor: Sending pitches to investors who do not fund your stage or sector results in quick rejections. Targeted outreach aligned with an investor’s focus significantly improves response rates.

- Not Understanding Dilution: Many founders accept terms without grasping long-term equity impact. Poor early decisions can limit control and future flexibility. Understanding the trade-offs of ownership is essential before signing any deal.

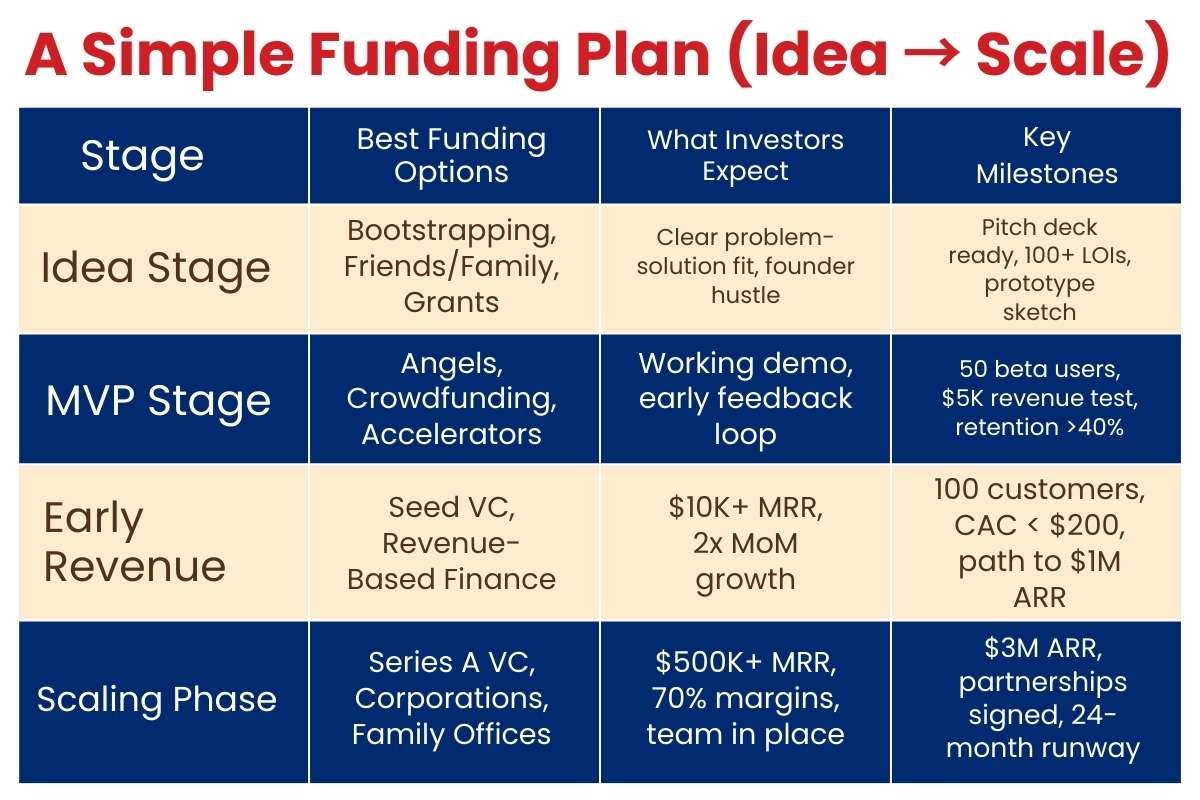

A Simple Funding Plan (Idea → Scale)

Map your path from napkin sketch to $10M run rate. Each stage lists top options, investor expectations, and milestones.

| Stage | Best Funding Options | What Investors Expect | Key Milestones |

| Idea Stage | Bootstrapping, Friends/Family, Grants | Clear problem-solution fit, founder hustle | Pitch deck ready, 100+ LOIs, prototype sketch |

| MVP Stage | Angels, Crowdfunding, Accelerators | Working demo, early feedback loop | 50 beta users, $5K revenue test, retention >40% |

| Early Revenue | Seed VC, Revenue-Based Finance | $10K+ MRR, 2x MoM growth | 100 customers, CAC < $200, path to $1M ARR |

| Scaling Phase | Series A VC, Corporations, Family Offices | $500K+ MRR, 70% margins, team in place | $3M ARR, partnerships signed, 24-month runway |

Conclusion: Funding Is a Strategy, Not a Goal

Funding does not validate a startup. Execution does. Capital works best as a tool to scale what already shows demand, not as proof of success. Founders who approach fundraising strategically tend to secure better terms and retain control over time.

The strongest companies choose Funding for a Startup paths that fit their stage and business model rather than chasing capital broadly. Some grow through disciplined cash flow, while others scale through outside investment at the right moment. How to get funding for a startup? It comes down to preparation, timing, and precise alignment with the right investors. This guide is designed to remain useful beyond a single raise, helping founders make informed funding decisions as their businesses grow.