India now counts more than 350 billionaires, with fresh names joining the club almost every week over the last few years. What truly grabs attention is how young many of them are. The youngest billionaires in India are reaching this milestone in their 20s and early 30s, mainly driven by startups in quick delivery, fintech, and digital services. Founders like Kaivalya Vohra and Aadit Palicha of Zepto have become symbols of this shift, building a multi-billion-dollar company while most people their age are still figuring out their careers.

Many of these founders took bold calls early in life. Vohra left Stanford during the pandemic to focus entirely on Zepto, betting everything on speed, timing, and execution. Others followed similar paths. Rohan Gupta scaled SG Finserve during India’s credit expansion, while Shashvat Nakrani helped grow BharatPe by tapping into the needs of small merchants. Their success came from spotting gaps early and moving faster than larger players.

Recent Hurun data shows the average age of new billionaire entrants has dropped by nearly three years. The youngest billionaires in India now combine sharp tech understanding with relentless effort, proving that inherited wealth is no longer the only route to success. Their journeys offer hope to young Indians across Bengaluru, Mumbai, and smaller cities who dream big.

In this article, we have curated a list of 15 of the youngest billionaires in India, along with their stories, key sectors, and lessons worth learning.

The Rise of India’s Youth Wealth Era

India’s billionaire count crossed 350 last year, and the pace has only quickened in 2026 with startups fueling most of the growth. Young founders now dominate the headlines, pushing the youngest billionaires in India to the forefront of this wealth surge. Quick commerce giants like Zepto, fintech disruptors such as BharatPe, and emerging AI players have created overnight success stories that were rare just a decade ago. This boom ties directly to India’s digital economy, where smartphone users have reached 1 billion and internet speeds enable same-hour deliveries. The government is pushing startups through funds like the ₹10,000 crore venture capital program, which has also opened wide the doors for these risk-takers.

What sets this wave apart is the shift from family empires to self-made fortunes. Older lists featured heirs to steel or pharma dynasties, but today’s youngest billionaires in India built from dorm rooms or small teams. Zepto’s duo started with a simple idea during lockdowns, while fintech firms rode the UPI revolution that processed over 15 billion transactions monthly by 2025. Sectors like these saw valuations grow 300% over three years, according to recent reports, as investors poured $25 billion into Indian startups last year alone. Cities like Bengaluru and Mumbai became hotbeds, attracting talent from IITs and even tier-2 colleges.

This rise comes amid broader changes. India’s GDP growth near 7% supports consumer spending on apps and services that these founders target. Yet challenges remain, from funding winters to competition with global players. Still, their average entry age dropped to 29 in the latest tallies, signaling a new norm where college dropouts outpace MBAs. These stories redefine ambition for India’s youth.

List of 15 Youngest Billionaires in India

| Rank | Name | Age (2026) | Net Worth (₹ Cr) | Company/Sector | Key City |

| 1 | Kaivalya Vohra | 23 | 4,480 | Zepto (Quick Commerce) | Bengaluru |

| 2 | Aadit Palicha | 24 | 5,380 | Zepto (Quick Commerce) | Bengaluru |

| 3 | Rohan Gupta | 27 | 1,140 | SG Finserve (Fintech) | Mumbai |

| 4 | Ishaan Gala | 28 | ~2,500 | Groww (Fintech) | Bengaluru |

| 5 | Shashvat Nakrani | 28 | 1,340 | BharatPe (Fintech) | Delhi |

| 6 | Hardik Kothiya | 31 | ~1,500 | Rayzon Solar (Renewable Energy) | Surat |

| 7 | Harsha Reddy Ponguleti | 31 | ~1,300 | Raghava Constructions (Real Estate) | Hyderabad |

| 8 | Trishneet Arora | 32 | ~1,850 | TAC Security (Cyber) | Chandigarh |

| 9 | Aditya Halwasia | 32 | ~1,980 | Cupid (Trade) | Kolkata |

| 10 | Ritesh Agarwal | 32 | 14,400 | OYO (Hospitality) | Gurugram |

| 11 | Aravind Srinivas | 32 | ~21,200 | Perplexity AI | Chennai |

| 12 | Alakh Pandey | 33 | ~2,000 | PhysicsWallah (Edtech) | Noida |

| 13 | Rohit Bansal | 35 | ~1,200 | AceVector Group (SaaS & D2C) | Bengaluru |

| 14 | Ravi Modi | 35 | ~3,000 | Construction/Realty | Mumbai |

| 15 | Nikhil Kamath | 38 | 15,000+ | Sixth Sense Ventures | Bengaluru |

1. Kaivalya Vohra (Age 23, Zepto)

- Key Facts: Co-founder and CTO of Zepto; dropped out of Stanford at 19; net worth ₹4,480 Cr as per Hurun 2025; pioneered 10-minute grocery delivery.

- Early Life: Born and raised partly in Bengaluru and Dubai; childhood friend of co-founder Aadit Palicha.

Kaivalya Vohra grew up coding with his best friend Aadit in Mumbai schools, building small apps long before most teens worried about college applications. At 17, they launched Kiranakart, a WhatsApp-based grocery service that gave them fast lessons on customer behavior during pandemic lockdowns. Dropping out of Stanford was a bold move, but Kaivalya chose to bet on building Zepto’s tech backbone, handling everything from dark store logistics to app speed that keeps deliveries under 10 minutes.

Today, as one of the youngest billionaires in India, he focuses on scaling Zepto across hundreds of stores nationwide, proving that solving everyday problems like late-night grocery runs can create massive value. His low-key style, often seen in simple tees at company events, hides a sharp mind that turned a dorm-room idea into a $5 billion valuation.

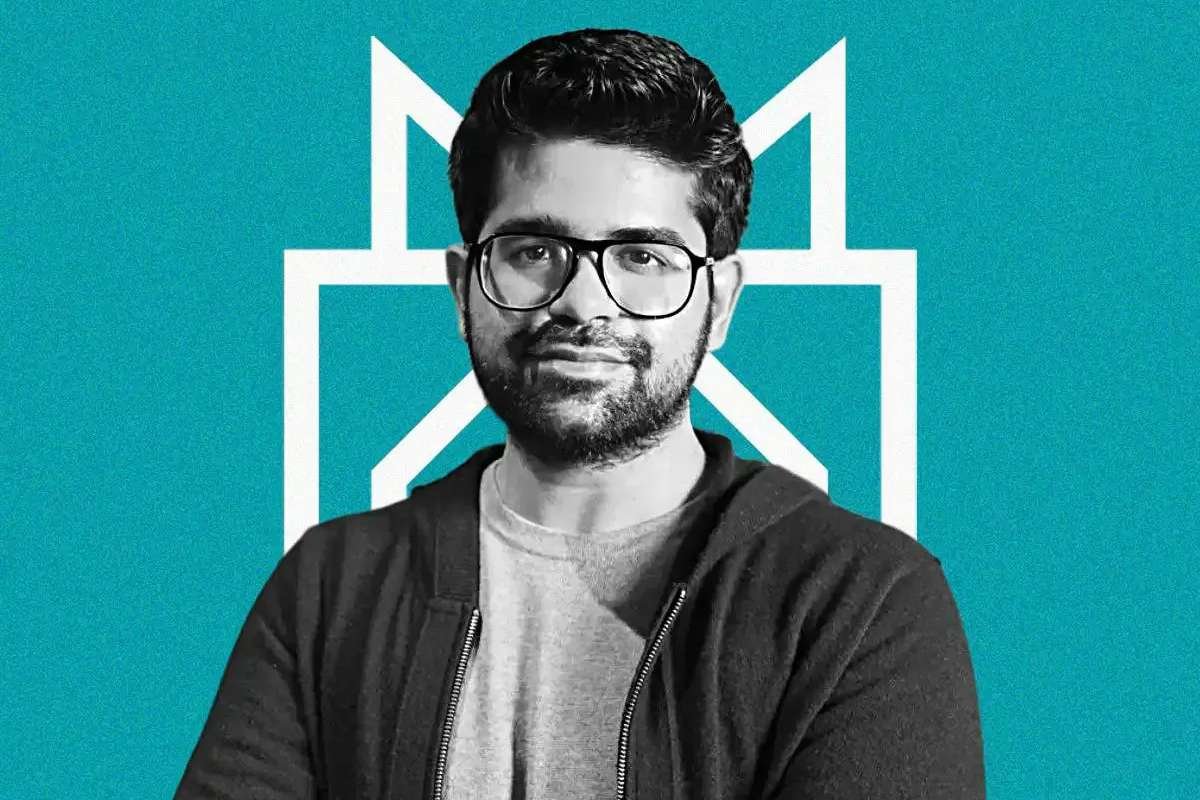

2. Aadit Palicha (Age 24, Zepto)

- Key Facts: Co-founder and CEO of Zepto; Stanford dropout; net worth ₹5,380 Cr; led funding rounds from Y Combinator and Nexus.

- Early Ventures: Started GoPool carpool app at 17; pivoted Kiranakart to the Zepto model.

Aadit Palicha and Kaivalya shared school desks and a love for coding from a young age in Mumbai, where their engineer fathers sparked early tech curiosity. While most classmates focused on grades, Aadit built GoPool and later jumped into online groceries during COVID, spotting the urgent need for fast access to essentials. He leads Zepto’s growth push, driving teams to open dark stores in busy neighborhoods and deliver on the 10-minute promise that won over millions.

Among the youngest billionaires in India, Aadit’s edge shows in how Zepto took on giants like Blinkit, raising over $360 million by backing execution over hype. He still lives, putting in long hours to sustain near 200% yearly growth, a clear sign that early conviction can pay off.

3. Rohan Gupta (Age 27, SG Finserve)

- Key Facts: Founder of SG Finserve; non-banking finance player; net worth ₹1,140 Cr; scaled lending to small businesses.

- Background: Bootstrapped from college days; focused on credit access in tier-2 cities.

Rohan Gupta noticed a lending gap when banks overlooked small traders during his early college years. He built SG Finserve from a modest setup in Mumbai, offering fast loans to merchants through simple digital tools, riding India’s UPI boom that made cashless payments routine. By 25, his company turned profitable, attracting investors who saw value in serving underbanked businesses. As part of the youngest billionaires in India group, Rohan’s journey resonates with founders from regular backgrounds, showing how brilliant timing and practical credit checks can scale a side project into a billion-rupee lender. He is now expanding deeper into rural markets, proving that growth follows real demand.

4. Pearl Kapur (Age 32, Zyber 365 Group)

- Key Facts: Founder of Zyber 365 Group; cybersecurity and Web3 infrastructure entrepreneur; net worth estimated above ₹1,000 Cr; built enterprise-focused digital security platforms.

- Background: Started early ventures in IT services; expanded into blockchain security and digital asset protection.

Pearl Kapur began his career in technology services before moving into cybersecurity at a time when Indian enterprises were still catching up on digital protection. He founded Zyber 365 Group to address rising threats across cloud systems, digital identities, and blockchain networks. As cyber risks grew alongside digital adoption, his company gained traction with large corporates and government-linked projects. By focusing on enterprise clients rather than consumer apps, Pearl built steady revenues and long-term contracts that pushed valuations sharply higher. His rise reflects how security-first businesses can quietly scale into billion-rupee ventures without public hype.

5. Shashvat Nakrani (Age 28, BharatPe)

- Key Facts: CTO and co-founder of BharatPe; soundbox technology pioneer; net worth ₹1,340 Cr; IIT Kanpur alumnus.

- Innovation: Built merchant lending systems using UPI audio confirmations.

Shashvat Nakrani built BharatPe’s core technology during his IIT Kanpur days, designing soundboxes that instantly confirm UPI payments for shopkeepers and eliminate cash confusion. Based in Delhi, he scaled merchant lending to lakhs of kirana stores by intelligently leveraging transaction data, bypassing traditional banking delays. Internal challenges tested the company, but its technology kept BharatPe stable through valuation swings. Ranked among the youngest billionaires in India, Shashvat maintains a quiet, focused approach, prioritizing systems that move billions in merchant loans each year. With IPO plans ahead, his engineering work remains central to BharatPe’s future.

6. Hardik Kothiya (Age 31, Rayzon Solar)

Key Facts: Director at Rayzon Solar; renewable energy entrepreneur; net worth estimated above ₹1,000 Cr; major player in solar module manufacturing.

Growth Driver: Expanded capacity rapidly as India pushed domestic solar production.

Hardik Kothiya entered the renewable energy space early, recognizing the opportunity created by India’s push for clean power and local manufacturing. At Rayzon Solar, he helped scale production facilities to meet rising demand from utility-scale projects and rooftop installations. As imports slowed and domestic sourcing increased, the company’s revenues surged, driving valuations higher. Hardik focused on efficiency and volume rather than branding, allowing Rayzon to compete aggressively on price. His journey shows how green energy manufacturing, often overlooked compared to startups, can still create young billionaires.

7. Harsha Reddy Ponguleti (Age 31, Raghava Constructions)

- Key Facts: Promoter and key stakeholder of Raghava Constructions; real estate entrepreneur; net worth around ₹1,300 Cr; scaled affordable and mid-tier housing projects across South India.

- Growth Path: Focused on timely delivery and cost efficiency to meet rising urban housing demand.

Harsha Reddy Ponguleti entered the real estate sector after identifying a gap in affordable urban housing in Hyderabad and its neighbouring regions. He expanded Raghava Constructions from a regional builder into a company delivering large residential and mixed-use projects that appeal to first-time homebuyers and mid-income families. His strategy emphasised quality construction, on-time delivery, and strong local partnerships, helping the company grow even during slower market cycles. As a result, promoter holdings and project sales pushed his personal net worth into billionaire territory while still in his early 30s. Harsha’s journey shows that real estate execution and disciplined project management remain powerful pathways to wealth creation beyond tech startups.

8. Trishneet Arora (Age 32, TAC Security)

- Key Facts: Founder of TAC Security, a cybersecurity firm serving Fortune 500 clients; net worth around ₹1,850 Cr; school dropout at 16.

- Milestones: Solved cybercrime cases for the CBI at 19; clients include Tata Group and ADB.

Trishneet Arora left school early in Chandigarh and taught himself hacking through books while others focused on exams. By 18, he was solving cyber fraud cases for the Punjab Police, which led him to start TAC Security. The firm helps banks and governments detect threats early by using AI to flag risks before breaches occur. As ransomware attacks grew nearly 50% year on year, TAC audited more than 200 global companies. Without formal degrees, Trishneet built partnerships with Microsoft-linked firms and scaled TAC into a Nasdaq-listed player. He now trains ethical hackers, showing how cybersecurity rewards sharp skills from any corner of India.

9. Aditya Kumar Halwasia (Age 32, Cupid Ltd)

- Key Facts: Promoter of Cupid Trade; condom and pharma exporter; net worth around ₹1,980 Cr; expanded a family business into a market favorite.

- Growth Hack: Pivoted to strong domestic and export demand during COVID, driving a 500 percent stock rise in 2025.

Aditya Halwasia took charge of Cupid in Kolkata at a young age, spotting rising awareness around health and protection as conversations moved online. He expanded production, boosted exports to 20 countries, and added personal care products when pandemic demand surged. Strong earnings pushed the small-cap stock sharply higher, creating wealth as retail investors joined in. Coming from a trading background, Aditya added e-commerce channels and sharper branding to compete with global names. He stays low-key, focusing on operations while expanding into wellness gels as India’s health market grows.

10. Ritesh Agarwal (Age 32, OYO)

- Key Facts: Founder of OYO Rooms; started at 19 with Oravel; net worth ₹14,400 Cr; backed by SoftBank.

- Journey: Expanded to nearly one lakh hotels worldwide; rebuilt the business after 2022 layoffs.

Ritesh Agarwal dropped out of college at 19 after an early startup failed, spending nights in budget stays to study gaps in India’s hotel market. OYO standardized rooms with basic amenities like AC and WiFi, scaling across 80 countries as travelers sought reliable, low-cost options. Heavy funding fueled expansion, but mass layoffs in 2022 forced a reset. By 2025, Ritesh shifted focus to profitability and tech-led efficiency, leading to a NYSE listing. Based in Gurugram, he now looks toward premium stays, with OYO’s comeback highlighting persistence in a harsh industry.

11. Aravind Srinivas (Age 32, Perplexity AI)

- Key Facts: CEO of Perplexity AI; former DeepMind and OpenAI researcher; net worth around ₹21,200 Cr; IIT Madras alumnus from Chennai.

- Big Leap: Built an AI-powered search alternative to Google, crossing a $1 billion valuation in 2025.

Aravind Srinivas moved from IIT Madras to top AI labs in Silicon Valley before launching Perplexity, a search engine that delivers cited, real-time answers. Backed by Jeff Bezos, the platform grew quickly by offering subscriptions instead of ads, appealing to researchers and professionals. Aravind keeps close ties to India, hiring local engineers and scaling systems for a billion internet users. His calm, research-first approach turned great technical skill into a global product. With enterprise tools in the pipeline, Perplexity is changing how people access information every day.

12. Alakh Pandey (Age 33, PhysicsWallah)

Key Facts: Founder and CEO of PhysicsWallah; edtech entrepreneur; net worth around ₹2,000 Cr; scaled affordable online education nationwide.

Early Spark: Started teaching physics on YouTube; focused on low-cost access for tier-2 and tier-3 students.

Alakh Pandey began his journey as a teacher, uploading free physics videos for students who could not afford expensive coaching classes. His clear teaching style quickly built a loyal audience, especially among JEE and NEET aspirants from small towns. He later launched the PhysicsWallah app, combining live classes with low fees, which helped the platform scale rapidly after the pandemic. As enrollments crossed the million mark, the company reached unicorn status without heavy advertising spend. Alakh’s focus on affordability and trust turned education into a scalable business, making him one of India’s youngest self-made education billionaires.

13. Rohit Bansal (Age 35, AceVector Group)

- Key Facts: Co-founder of Snapdeal; founder of AceVector Group; net worth around ₹1,200 Cr; led Unicommerce and Stellaro Brands.

- Second Act: Built profitable SaaS and D2C brands after exiting Snapdeal’s core operations.

Rohit Bansal co-founded Snapdeal during India’s first e-commerce boom, helping the platform scale nationwide. After stepping back from day-to-day operations, he launched AceVector Group, focusing on SaaS tools and consumer brands that emphasized profitability over growth-at-all-costs. Under his leadership, Unicommerce became a key backend platform for online sellers, while Stellaro built strong private labels. Strategic exits and steady cash flows pushed AceVector’s valuation upward. Rohit’s career highlights how second-generation entrepreneurship and disciplined scaling can still deliver billionaire outcomes.

14. Ravi Modi (Age 35, Vedant Fashions – Manyavar)

- Key Facts: Promoter at Vedant Fashions; fashion retail entrepreneur; net worth around ₹3,000 Cr; scaled ethnic wear brand Manyavar globally.

- Retail Edge: Expanded franchise model across India and overseas markets.

Ravi Modi helped grow Manyavar into India’s most recognisable ethnic wear brand, catering to weddings and festive demand. By focusing on franchise-led expansion, the company scaled quickly without heavy capital costs. Strong brand recall and consistent demand supported high margins, making Vedant Fashions a strong performer after listing. Ravi’s role in expanding the brand’s global outlets contributed to its valuation. His journey reflects how retail, when paired with sharp branding and timing, can still produce young billionaires.

15. Nikhil Kamath (Age 38, Zerodha)

- Key Facts: Co-founder of Zerodha, India’s largest stock brokerage; net worth over ₹15,000 Cr; built a bootstrapped fintech giant.

- Wealth Creation: Achieved billionaire status before 35 through Zerodha’s profitability.

Nikhil Kamath started trading stocks as a teenager before co-founding Zerodha to cut brokerage costs for Indian investors. By eliminating commissions and focusing on technology, Zerodha became the country’s largest brokerage without external funding. Its consistent profits allowed Nikhil to build wealth early, even before turning 35. Beyond Zerodha, he invests in startups and public causes, but trading and brokerage remain the core of his success. His inclusion reinforces the idea that disciplined, bootstrapped businesses can outperform flashy, funding-driven models.

Sector Breakdown

Quick commerce and fintech lead the charge among these youngest billionaires in India, claiming 10 out of 15 spots with a combined net worth of over ₹30,000 Cr. Quick commerce like Zepto fills the top two ranks, while fintech players such as Groww, BharatPe, and SG Finserve dominate the middle. Edtech leads, followed by PhysicsWallah and Propelld, then cybersecurity, AI, and hospitality round out the mix.

This spread shows clear patterns. Quick commerce is riding India’s urban rush for 10-minute groceries, fueled by 1 billion smartphone users and a faster 5G rollout. Fintech taps UPI’s 15 billion monthly transactions, serving small shops and first-time investors ignored by banks. Edtech exploded as JEE and NEET coaching reached a market size of ₹60,000 Cr, with digital loans making classes accessible to tier-2 families.

Other sectors hint at broader shifts. AI via Perplexity signals India’s tech talent going global, while real estate and trade prove old-school businesses can still scale with innovative twists. Quick commerce holds 40% of total list wealth despite just two names, showing explosive valuations, but fintech spreads risk across more founders. This mix reflects India’s economy, where digital services meet daily needs at scale.

Who are the 12 Richest People in India Right Now? Updated 2026 List

Conclusion

The rise of the youngest billionaires in India marks a clear shift in how wealth is being created in the country. These founders did not rely on legacy businesses or inherited capital. Instead, they spotted gaps in daily life, used technology at scale, and moved faster than traditional players. From 10-minute grocery delivery and fintech platforms to edtech, AI, and cybersecurity, their journeys reflect where India’s economy is headed next.

What stands out across all 15 stories is timing paired with execution. Most of them started young, took risks early, and stayed focused on solving real problems for millions of users. Their success also shows how opportunity is no longer limited to metros alone, with tier-2 cities playing a growing role. As India moves toward a future with more founders, deeper digital adoption, and global-facing startups will emerge.