Key Points:

- Industrial output up 3.5% in July, 4-month high.

- Manufacturing +5.4% led by metals & equipment.

- Mining -7.2%, electricity weak at +0.6%.

India industrial output expanded by 3.5% in July, marking the sharpest growth in four months and signaling improving momentum in the manufacturing sector, according to data from the Ministry of Statistics and Programme Implementation. The latest figure represents a notable rebound from June’s 1.5% growth, providing relief for businesses after a muted start to the financial year.

The Index of Industrial Production (IIP), a key indicator of factory activity, showed that manufacturing remained the primary driver of growth, offsetting declines in mining and modest expansion in electricity.

Manufacturing Drives Expansion

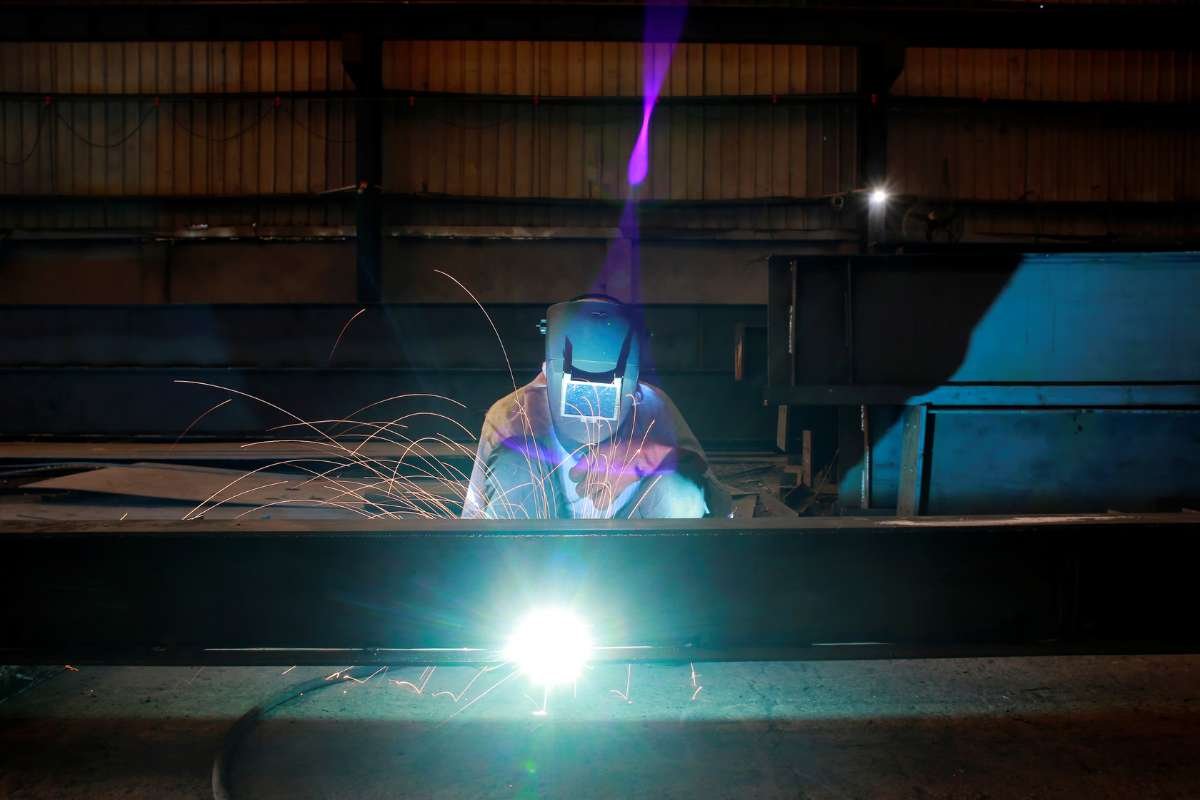

Manufacturing activity surged 5.4% in July, with 14 out of 23 industry groups reporting positive growth. Sectors such as electrical equipment (15.9%), basic metals (12.7%), and non-metallic mineral products (9.5%) were among the strongest performers. The rise in basic metals and steel products is seen as a positive sign for construction, infrastructure, and allied industries, which rely heavily on these inputs.

The output of capital goods, often viewed as a barometer of investment activity, also expanded by 5%. Consumer durables climbed 7.7%, reflecting steady demand for household goods, while non-durables recorded marginal growth at 0.5%. Intermediate goods and construction goods rose by 5.8% and 11.9%, respectively, indicating strength in supply chains and infrastructure-linked demand.

Industry analysts note that these improvements in key manufacturing segments could help businesses ramp up production schedules and stabilize supply chains ahead of the festive season, when demand traditionally rises.

Weakness in Mining and Electricity

In contrast, mining activity contracted by 7.2% in July, reflecting lower output from coal and mineral production. This downturn has raised concerns among industries dependent on raw materials, particularly energy-intensive sectors. Electricity generation inched up by only 0.6%, signaling a subdued increase in power demand compared to previous months.

Despite these weaknesses, the overall rise in India industrial output was strong enough to offset sectoral imbalances. Industry groups believe that the sustained rise in manufacturing could help absorb some of the pressures created by weaker mining activity.

Implications for Businesses

For companies across construction, consumer goods, and manufacturing, the July IIP data suggests an improving operating environment. Stronger demand for metals and electrical equipment is expected to encourage investment in capacity expansion, while the uptick in consumer durables hints at resilience in household spending.

However, the contraction in mining output remains a concern for industries that rely on raw material availability and cost stability. If this trend continues, businesses in metals, cement, and power generation could face higher input costs.

Looking ahead, businesses will be closely monitoring whether manufacturing momentum sustains in the coming months. A balance between raw material availability and consumer demand will likely shape the trajectory of India industrial output for the remainder of the year.

Visit Business Viewpoint Magazine For The Most Recent Information.