Financial technology, or The fintech revolution, means innovative technology aimed to enhance and automate financial services. It empowers businesses, individuals, and consumers to manage their financial operations smoothly and efficiently through software algorithms on smartphones and computers.

Fintech has made a significant impact on the financial sector, leveraging cutting-edge technologies—AI, robotics, biometrics, blockchain, and peer-to-peer lending. Many startup companies like PayPal, GlodMoney, and Alipay have embraced these opportunities to revolutionize the market.

Initially working on backed systems of established financial institutions, fintech has now begun with customer-oriented services: education, retail banking, fundraising, investment management, and more.

This report delves into the current state of the fintech industry, examines prevailing trends and challenges, and provides projections for its future trajectory.

Executive Summary

The fintech revolution reshapes traditional financial services by introducing innovative solutions that boost efficiency, accessibility, and customer experience. In recent years, technological advancements and changing consumer preferences have fueled the sector’s exponential growth.

Despite global economic uncertainties, fintech investment remained strong, totaling $95.6 billion across 4,639 deals in 2024—a seven-year low but a testament to the industry’s resilience. Key trends include the rise of artificial intelligence (AI) in financial services, increased mergers and acquisitions (M&A), and a shift towards sustainable and inclusive financial solutions.

Industry Overview

The Fintech revolution leverages technology to modernize financial services across various domains, including digital payments, lending, wealth management, blockchain applications, and insurance solutions. The sector has progressed from simple online banking tools to sophisticated AI-driven financial guidance and decentralized finance (DeFi) platforms.

The competitive landscape continues to evolve as innovative firms challenge traditional financial institutions, redefining how businesses and individuals manage money. Leading companies such as Stripe, PayPal, Square, and Ant Financial remain at the forefront of this transformation.

A diverse ecosystem of startups, technology firms, regulatory agencies, and established financial entities works together to drive the industry’s growth. This interconnected network spans foundational infrastructure, service platforms, compliance structures, and end-user applications, shaping the future of digital finance.

Market Analysis

Key Trends

A major development in the financial services sector is the growing integration of AI technology. By 2028, it is anticipated that 81% of global asset managers will seek strategic partnerships or acquire businesses that are capable of utilizing AI (Financial News London). AI-driven risk assessments, fraud detection, and tailored investment strategies are increasingly becoming standard practices in the industry.

A significant trend is the rise in mergers and acquisitions (M&A). Established financial institutions are increasingly buying fintech startups to boost their digital capabilities and stay competitive. Additionally, private credit firms have become attractive targets for acquisition as investment firms look to gain access to alternative financial markets (Business Insider).

Sustainability and financial inclusion are becoming increasingly important. Fintech companies are using technology to provide banking services to underserved communities, encourage responsible investing, and incorporate green finance initiatives.

Market Drivers and Challenges

Several key drivers fuel the rapid expansion of the fintech sector:

- Advances in AI, blockchain, and cloud computing.

- More people prefer digital financial services.

- Support from regulators is helping fintech grow in many areas.

Despite its growth, the industry faces challenges:

- Regulatory complexities as governments work to establish frameworks that balance innovation with consumer protection.

- Cybersecurity threats, with fintech firms being prime targets for financial fraud and data breaches.

- Market saturation, as increased competition makes differentiation more challenging.

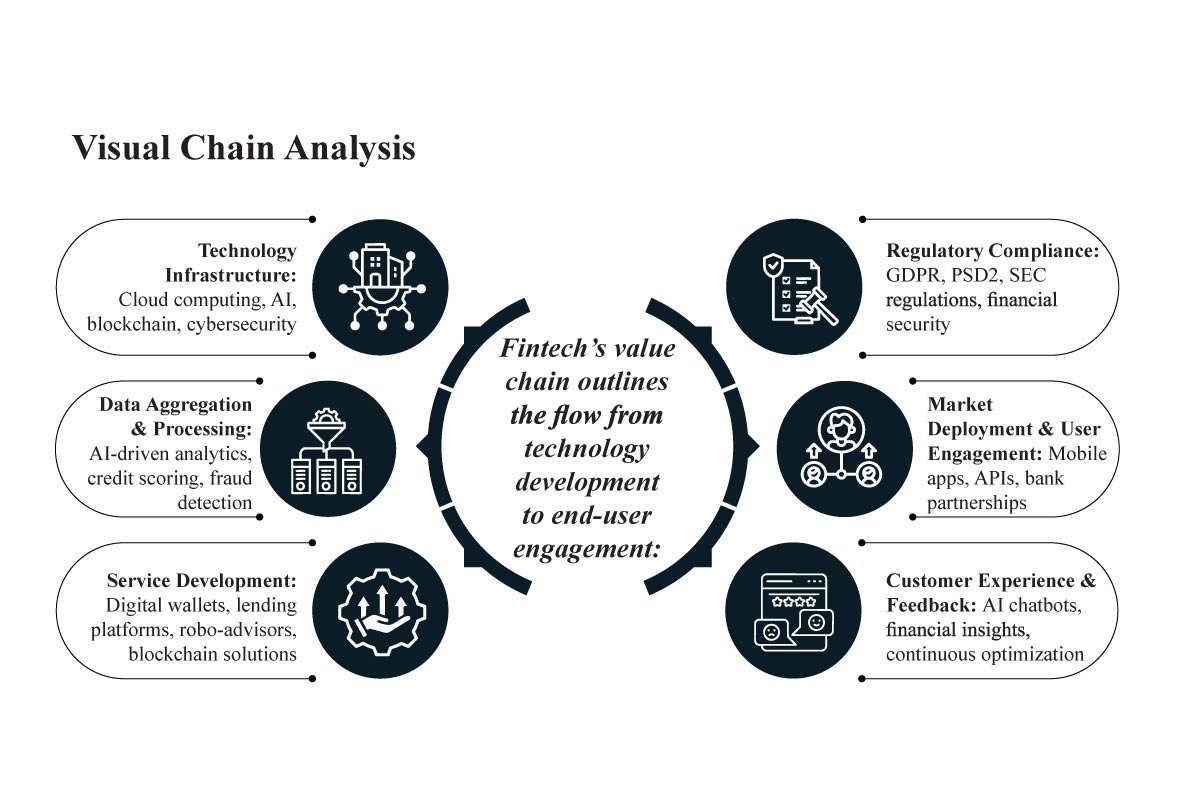

Visual Chain Analysis

Fintech’s value chain outlines the flow from technology development to end-user engagement:

- Technology Infrastructure: Cloud computing, AI, blockchain, cybersecurity

- Data Aggregation & Processing: AI-driven analytics, credit scoring, fraud detection

- Service Development: Digital wallets, lending platforms, robo-advisors, blockchain solutions

- Regulatory Compliance: GDPR, PSD2, SEC regulations, financial security

- Market Deployment & User Engagement: Mobile apps, APIs, bank partnerships

- Customer Experience & Feedback: AI chatbots, financial insights, continuous optimization

Competitive Analysis

To understand the dynamics of the fintech revolution, it is essential to examine the competitive landscape and external factors influencing its growth, risks, and opportunities.

| Sector | Leaders | Challenges |

| Payments & Digital Banking | PayPal, Stripe, Square, Revolut, Alipay | Regulation, fraud risks, customer acquisition |

| Lending & Alternative Credit | SoFi, LendingClub, Upstart, Affirm | Interest rates, defaults, compliance |

| Wealth Management & Robo-Advisory | Betterment, Wealthfront, Robinhood, Vanguard Digital Advisor | Trust, regulation, economic downturn |

| Blockchain & Crypto | Binance, Coinbase, Ripple, Ethereum-based DeFi platforms | Regulation, volatility, cybersecurity |

| Open Banking & API Services | Plaid, Tink, TrueLayer, OpenBanking.org | Data privacy, banking partnerships, adoption |

PESTEL Analysis

- Political: Governments are developing policies to regulate fintech while encouraging innovation.

- Economic: Global financial instability impacts investment and adoption rates.

- Social: Rising demand for inclusive financial services supports fintech growth.

- Technological: AI, blockchain, and machine learning continue to revolutionize financial services.

- Environmental: Green fintech solutions, such as carbon footprint tracking, are emerging.

- Legal: Compliance with financial regulations remains a critical challenge for fintech firms.

Market Forecasts and Outlook

The fintech industry is set to keep growing, with AI integration and alternative asset management as key drivers. By 2028, AI-powered financial services are expected to become standard in investment and risk management, with most financial firms depending on machine learning for real-time decision-making. The emergence of decentralized finance (DeFi) and blockchain technologies will also challenge traditional banking models. However, challenges such as stricter regulations, cybersecurity threats, and economic uncertainty could create risks. Companies that focus on compliance, cybersecurity, and innovative customer solutions will be in a stronger position for long-term success.

Conclusions and Recommendations

The fintech revolution is fundamentally transforming financial services, presenting opportunities and challenges.

Financial institutions should take the following steps to remain competitive:

- Invest in AI and Emerging Technologies: Adopting AI-driven financial tools and blockchain solutions can improve efficiency and security.

- Foster Strategic Partnerships: Collaborations with fintech startups can accelerate innovation and market expansion.

- Prioritize Regulatory Compliance: Keeping pace with evolving regulations will mitigate risks and build trust.

- Enhance Customer Experience: Digital-first solutions that cater to evolving consumer needs will drive long-term loyalty.

By embracing innovation while navigating regulatory challenges, financial institutions can successfully adapt to the fintech revolution and thrive in an increasingly digital landscape.

5 Fintech Use Cases

Fintech is rapidly transforming financial services, with North America leading innovation, while Asia and Europe follow closely.

Here are five key areas driving growth:

1. Robo-Advisory

AI-powered algorithms operate without human assistance for financial planning and investment recommendation robo advisors. With this technology, investing is set to become more user-friendly, cost-effective, and clear. Their 2022 AUM projection is $2.76 trillion, and it is expected to continue growing.

2. Alternative Lending

The fintech revolution offers peer-to-peer and online lending services that have transformed the process of lending, enabling small enterprises to borrow with ease. These platforms offer affordable loan options and flexible repayment plans. Leading companies include SpringLeaf Financial and Lendmark Financial.

3. Blockchain & Cryptocurrencies

With Blockchain, the need for third parties to reach out for validation in transactions is reduced which further enhances security and minimizes costs. The sector is estimated to reach $67.4 billion by 2026 because currencies such as Bitcoin, Ethereum, and Binance are revolutionizing decentralized finance (DeFi) and Digital Asset Exchange, also known as DAE.

4. Digital Payments

Fintech startups have transformed the world of digital payments by making it more user-friendly and efficient. The adoption of using cash as well as ATMs is on the decline. Services like PayPal and mobile banking apps have continued to gain traction, and ttheiradoption is growing immensely in cashless economies.

5. Open Banking

Open banking enables the secure sharing of financial data via APIs, empowering users to have greater control over their finances. Services like Mint compile account information, assisting users in monitoring their spending, setting budgets, and obtaining tailored financial insights.

Data and Sources

This report is based on data from industry reports, market research, and expert analysis. Sources include KPMG’s Pulse of Fintech (2024), PwC’s The Future of Financial Services (2023), and Financial News London’s reports on AI-driven M&A trends and fintech deal recoveries (2024). Additionally, insights from Business Insider (2024) on private credit firm acquisitions contribute to the analysis.

Reference Links:

- https://kpmg.com/xx/en/what-we-do/industries/financial-services/pulse-of-fintech.html?

- https://www.pwc.com/gx/en/industries/financial-services/publications/future-of-financial-services.html?

- https://www.fnlondon.com/articles/ai-demand-set-to-spark-m-a-deals-frenzy-among-fund-managers-799f3dfd?

- https://www.fnlondon.com/articles/fintech-deals-are-bouncing-back-but-dont-celebrate-just-yet-a4d6ae3c?

- https://www.businessinsider.com/private-market-asset-management-deal-outlook-2024-12?