When insurance companies depend on outdated systems, manual processes, and disconnected data, it slows down operations, increases compliance risks, and weakens customer satisfaction. Claims take longer to process, policy management becomes more prone to errors, and teams are often stuck solving problems instead of driving growth.

In today’s fast-moving digital world, this kind of inefficiency can lead to customer loss and limited business success. That’s where leading insurance tech solution providers play a vital role—they offer smart, scalable platforms that simplify everything from underwriting to claims, while also ensuring compliance and improving service delivery. With the help of AI, cloud-based tools, and flexible systems, they help insurers work more efficiently, reduce risks, and stay ahead in a competitive market.

Acess Meditech is one such company making a real difference. As a global InsurTech provider, it helps insurance companies modernize and automate their entire operations—from policy issuance and claims handling to reinsurance, compliance, and customer support. Its flagship platforms, LIMRA and Toshfa, are built in-house and fully customizable, designed to meet the specific needs of insurers and third-party administrators across the Middle East, Africa, and South Asia. These systems remove inefficiencies, data silos, and enhance overall performance with AI-powered tools, real-time dashboards, and smooth integration.

Acess Meditech’s impact is clear—in one case, it helped Al Sagr Cooperative Insurance consolidate over 48 insurance offerings into a single system, while in another, it delivered a relief module ahead of schedule for Al Etihad with full compliance. With more than 18 years in the industry, over $32 million in claims processed, and 15+ industry awards, the company continues to earn trust through innovation and results. Guiding this journey is Syed Aijazuddin, the Founder & Managing Partner, whose deep experience and focus on automation have made Acess Meditech a trusted partner for insurers in the digital age.

In-House Insurance Solutions

Acess Meditech is a global InsurTech solutions provider dedicated to transforming the insurance industry through innovation, efficiency, and automation. Since its founding in 2007, the company has delivered advanced ERP systems and customized digital solutions to insurance companies across the Middle East and Africa.

What makes Acess Meditech stand out is its comprehensive, end-to-end approach—covering everything from underwriting and claims to regulatory compliance—all developed in-house with a strong grasp of insurance business processes. Its flagship platforms, LIMRA and Toshfa, are fully customizable to meet the specific operational and regulatory needs of each client. With a strong focus on client satisfaction and dependable post-implementation support, Acess Meditech ensures smooth system integration and long-term scalability.

Insurance Operations Through Smart Automation

With over 30 years of experience in underwriting, operations, and leadership across India and the GCC, Syed is a seasoned insurance expert. He holds professional credentials from the Chartered Insurance Institute (UK) and America’s Health Insurance Plans (USA), bringing deep industry knowledge and a strong sense of purpose to his work.

He founded Acess Meditech to simplify and automate the manual processes that once slowed down insurers. Under his vision and leadership, the company has grown into a trusted provider of advanced insurance ERP systems—enhancing daily operations through smart design, automation, and continuous innovation.

Custom Modules for Regulatory and Operational Needs

Acess Meditech offers a range of core solutions that simplify and strengthen insurance operations by addressing key functional and regulatory needs. Each offering is built to help insurers reduce manual work, streamline workflows, and stay compliant in a fast-changing market.

Their core offerings include:

- LIMRA: A comprehensive, end-to-end insurance ERP that covers policy issuance, underwriting, claims management, reinsurance, renewals, and customer servicing.

- Toshfa: A modular health insurance platform designed specifically for third-party administrators (TPAs) and insurers, offering flexible deployment and seamless integration.

Custom Modules: Built to address regulatory and operational needs, including:

- NPHIES integration for the Saudi market

- Anti-Money Laundering (AML) compliance

- Human Resource Management (HRM)

- Customer Relationship Management (CRM)

These platforms are designed to solve common industry challenges such as fragmented systems, manual data handling, and compliance gaps. By offering unified, scalable, and automation-driven solutions, Acess Meditech helps insurance providers improve operational efficiency, deliver better customer experiences, and accelerate their digital transformation.

The company’s solutions come pre-configured to meet stringent regulatory requirements across multiple jurisdictions. In Saudi Arabia, the systems ensure full compliance with NPHIES and NHIC standards, while in the UAE they incorporate Central Bank reporting frameworks. For APAC markets, Acess Meditech has developed localized AML/KYC protocols, and all platforms are designed with GDPR-ready data privacy controls to meet global standards.

Boosting Efficiency with AI-Powered Insurance Tools

Acess Meditech uses AI and machine learning to make data retrieval faster, improve user experience, and boost overall efficiency. Features like the AI-powered Dynamic Search Bar and CoPilot assistant allow employees to carry out context-based searches, take quick actions, and easily navigate complex systems. These tools help reduce operational hurdles and allow teams to focus more on strategic tasks.

Acess Meditech’s technological edge manifests in several groundbreaking features. The AI CoPilot system dramatically reduces operational inefficiencies, enabling users to process complex queries like “Show all pending claims above $50K” through simple conversational commands, achieving a 65% reduction in search time. Its Dynamic Search functionality leverages natural language processing to retrieve documents from databases containing over 10 million records in under two seconds. The company is also piloting blockchain applications for cross-border reinsurance settlements and exploring IoT integration to enable innovative usage-based insurance models for both auto and health insurance products.

The company is also exploring the use of blockchain to bring more transparency to claims and enable real-time settlement updates. Additionally, it is looking into IoT integrations to support usage-based insurance (UBI) and dynamic risk assessment.

Unifying 48+ Insurance Products into One Seamless System

The transformative effect of Acess Meditech’s solutions is perhaps best illustrated through its work with Al Sagr Cooperative Insurance, where the implementation consolidated 48 separate insurance products into a unified platform, resulting in a 40% improvement in policy issuance speed and a 30% reduction in reconciliation errors.

Similarly, for the Al Etihad Relief Program, Acess Meditech delivered a SAR 12 million disbursement module in just eight weeks—25% ahead of schedule—while maintaining full compliance with all Saudi labor ministry requirements.

Flexible Insurance Tech Built Around Your Workflow

Acess Meditech tailors its solutions by recognizing that each insurance company has unique products, compliance needs, and operational structures. Instead of offering a one-size-fits-all system, the company builds custom solutions that allow insurers to configure workflows, define underwriting rules, set up claims processes, manage reinsurance frameworks, and create integration paths that align with their specific goals. This process begins with detailed business analysis and continues through customization, user acceptance testing (UAT), deployment, and ongoing support. By working closely with each client, Acess Meditech ensures smoother adoption, minimal disruption, and long-term value from its solutions.

Expansion into High-Growth APAC Markets

Acess Meditech strategically focuses on regions and customer segments where digital innovation and regulatory compliance are becoming critical to business success. With deep domain expertise and adaptable technology, the company delivers solutions that align with the operational realities and transformation goals of modern insurers.

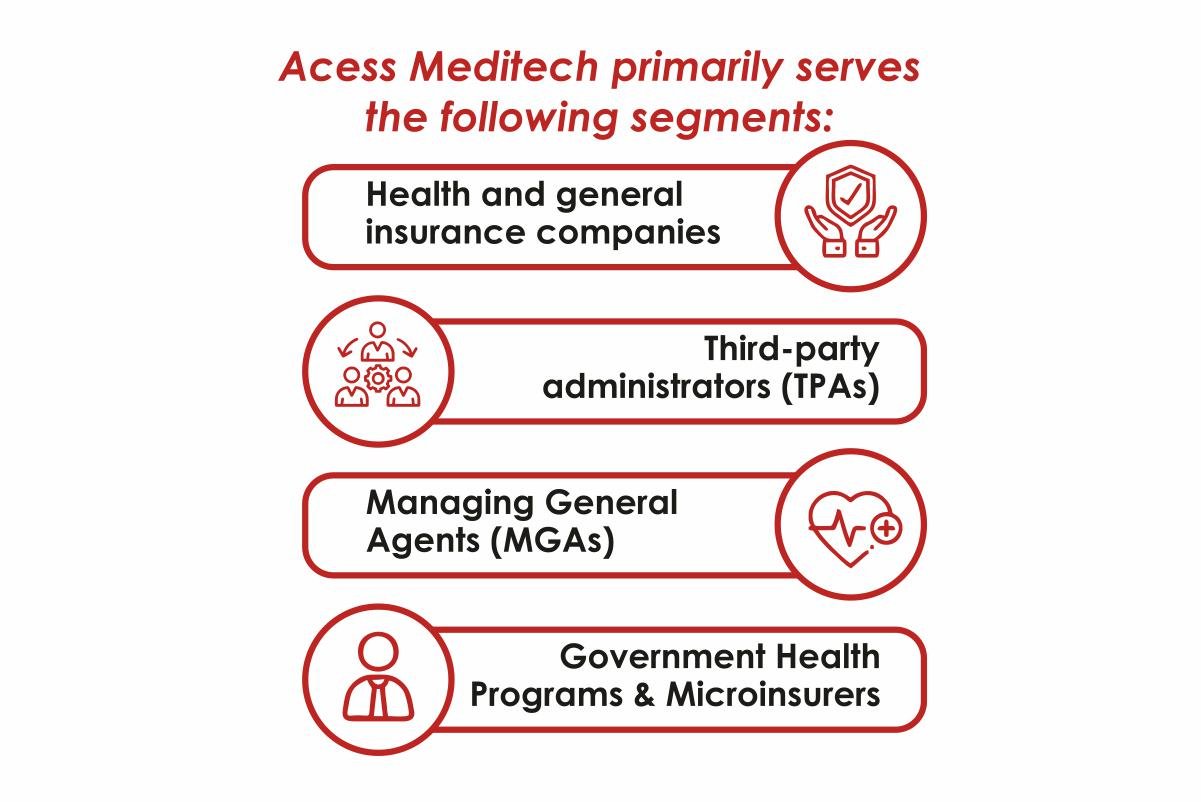

Acess Meditech primarily serves the following segments:

- Health and general insurance companies

- Third-party administrators (TPAs)

- Managing General Agents (MGAs)

- Government Health Programs & Microinsurers

Its key markets include Saudi Arabia, UAE, with a strategic focus on global growth. To support this growth, the company has formed dedicated teams that are actively working on market-entry strategies across APAC. It is also collaborating with local compliance experts to develop ERP systems tailored to regional regulations and business environments, ensuring smooth adoption and operational alignment.

Further strengthening its position, Acess Meditech is introducing modular product lines designed specifically for smaller insurers and managing general agents (MGAs) who value flexibility. As part of its broader innovation strategy, the company is also building strategic partnerships aimed at enhancing AI functionality and expanding cloud deployment capabilities across its core markets.

Acess Meditech’s excellence has been consistently recognized by the industry, earning prestigious accolades including the Innovative Solutions Provider award from Enterprise World in 2020, consecutive Top Insurance Tech Company honors from APAC CIO Outlook in 2017 and 2018, the Best Tech Company distinction from Silicon Review in 2017, and the Insurance ERP of the Year award from Xel Research in 2014. These awards reflect the company’s unwavering commitment to innovation, client satisfaction, and operational excellence in the InsurTech space.

These ongoing efforts are supported by a strong foundation of industry experience and performance, reflected in the company’s milestones and recognitions:

- Over 18 years of experience in the InsurTech industry

- Serving 16+ clients globally with more than $32 million in claims processed, Acess Meditech has earned the trust of numerous insurance providers across key markets.

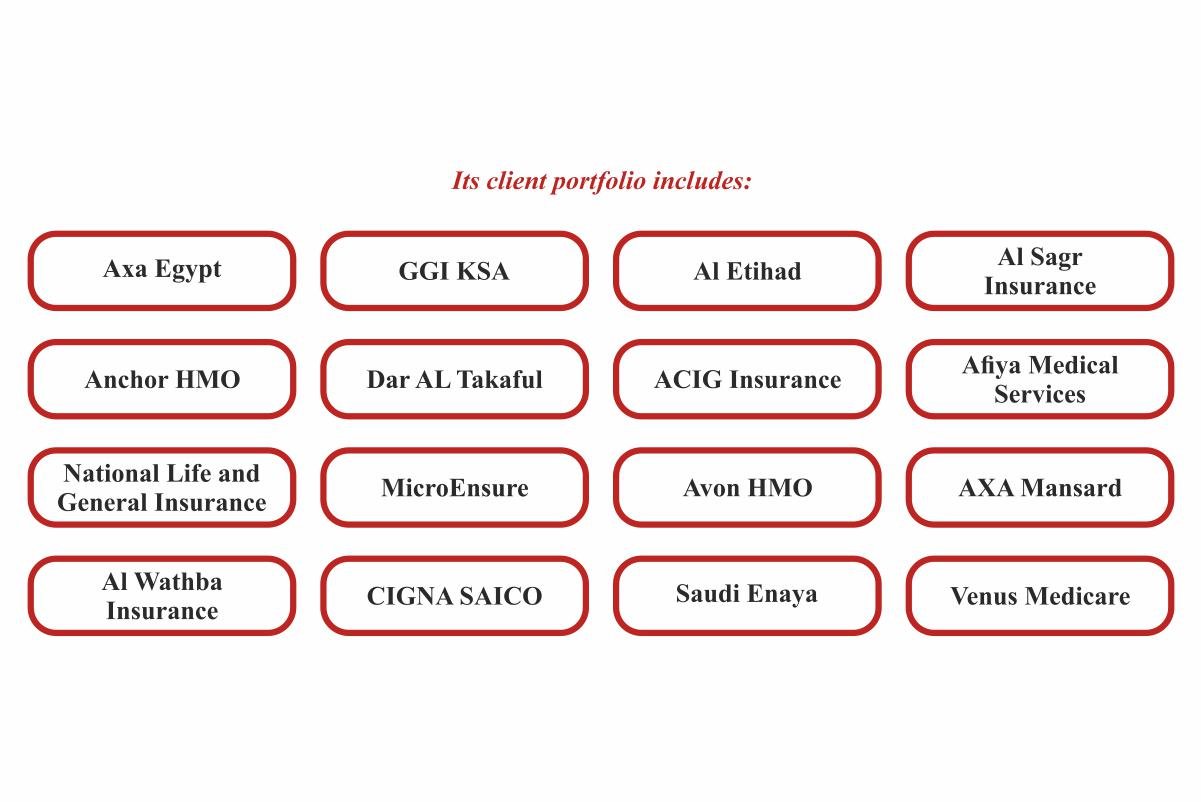

Its client portfolio includes:

- Axa Egypt

- GGI KSA

- Al Etihad

- Al Sagr Insurance

- Anchor HMO

- Dar AL Takaful

- ACIG Insurance

- Afiya Medical Services

- National Life and General Insurance

- MicroEnsure

- Avon HMO

- AXA Mansard

- Al Wathba Insurance

- CIGNA SAICO

- Saudi Enaya

- Venus Medicare

- 100% in-house product development with no third-party dependencies

- Integrated NPHIES and NHIC compliance modules for the Saudi Arabian market

- Strong year-over-year client retention and referral-based growth

- Recognized with 15+ industry awards for innovation and performance

Meeting Rising Demands

Syed highlights that the insurance industry is undergoing a period of rapid change, and with it come several pressing challenges. He points out that many insurers are still dependent on outdated legacy systems that lack the flexibility to keep up with evolving business demands. “There’s also increasing pressure to comply with strict data privacy and reporting regulations, while customers now expect digital-first, seamless experiences across the board,” he notes. Another major concern, he explains, is the fragmentation of data across departments, which leads to inefficiencies and delayed decision-making. To overcome these hurdles, Acess Meditech delivers modular yet unified technology solutions equipped with compliance-ready frameworks, AI-powered tools, and real-time dashboards.

“Our goal is to help insurers streamline their operations, enhance data accessibility, and transition into efficient, tech-driven service organizations,”

says Syed

Acess Meditech encourages insurance providers to modernize their operations using its advanced technology solutions. By adopting the company’s integrated ecosystem, organizations can improve efficiency, stay compliant, and enhance customer satisfaction. The Acess Meditech team supports clients at every stage of their digital transformation—from the first assessment to full implementation and continuous support.

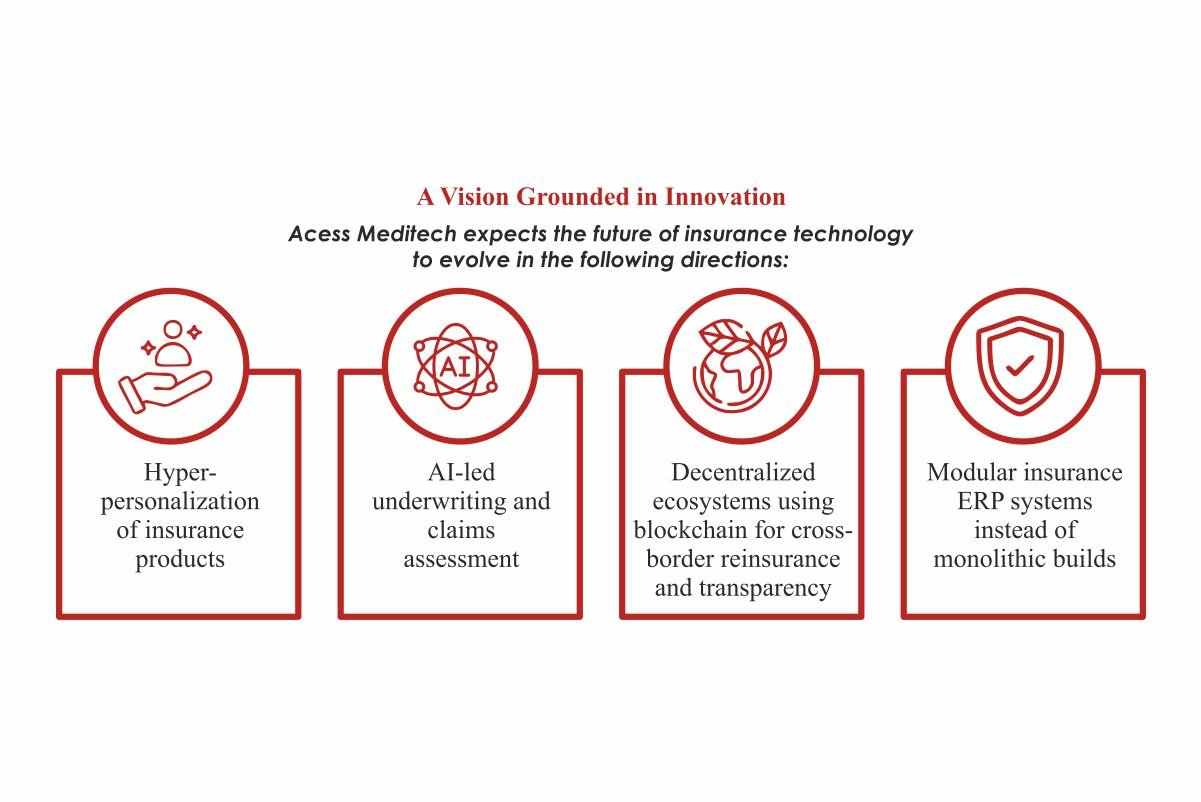

A Vision Grounded in Innovation

Acess Meditech expects the future of insurance technology to evolve in the following directions:

- Hyper-personalization of insurance products

- AI-led underwriting and claims assessment

- Decentralized ecosystems using blockchain for cross-border reinsurance and transparency

- Modular insurance ERP systems instead of monolithic builds

The company is actively investing in each of these areas, aiming to be a reliable partner—not just a provider—by helping insurers keep up with emerging technologies and changing customer expectations.

Looking ahead to 2025-26, Acess Meditech is focused on delivering hyper-personalized premium pricing through advanced AI algorithms and implementing automated claims settlement via smart contract technology. The company is developing modular, ‘plug-and-play’ ERP components to enhance flexibility and is actively expanding in the APAC region, with a strategic focus on global growth. It has expanded significantly, evolving into a cross-border delivery model with a strong presence in Saudi Arabia.

Strong Client Retention

Acess Meditech takes pride in the long-standing relationships it has built over the years. Several of its clients have been with the company for more than 15 years, a clear testament to its consistent performance, reliable technology, and commitment to customer satisfaction.

20% Annual Revenue Dedicated to Tech Innovation

Acess Meditech has experienced steady growth in recent years. The company has seen a rise in client acquisitions, particularly in GCC markets. It has consistently invested in research and development, allocating 20% of its annual revenue to technology innovation. The team has expanded significantly, evolving into a cross-border delivery model with a strong presence in Saudi Arabia.

Master the Fundamentals

Syed advises emerging leaders, entrepreneurs, and professionals entering the insurance technology industry to develop a strong foundation in domain knowledge, as a deep understanding of insurance at every level is crucial for long-term success. He emphasizes the importance of staying flexible in product design and prioritizing user-friendly experiences. Instead of chasing trends, he encourages focusing on solving real, industry-specific problems through practical and impactful innovation.

Transform Insurance Operations with Acess Meditech

Its AI-powered ERP eliminates manual bottlenecks, streamlines claims, and ensures regulatory compliance—so your team can focus on growth, not firefighting.

Trusted across the Middle East, Africa & APAC.

Let’s simplify your insurance workflows.

- Visit: www.acessmeditech.com

- Email: https://www.acessmeditech.com/contact